How NDVI data powers livestock insurance

/

By Professor Carol Ogutu, University of Nairobi

In arid and semi-arid regions, where rainfall determines not just the landscape but livelihoods, vegetation is a silent indicator of prosperity or hardship. For pastoralist communities, the greenness of the land often mirrors the health of their herds and, by extension, their economic security. But how can this environmental reality be translated into something measurable, predictable, and insurable?

According to Professor Caroline Ogutu, an actuary working closely with the Geographic Information System (GIS) team, the answer lies in data, specifically, in the Normalized Difference Vegetation Index (NDVI).

“As an actuary, our role is to bridge the gap between scientific data and financial decisions,” she explains. “We work with the GIS team to understand what the NDVI data represents. Then I help translate those patterns into measurable triggers that can be linked to livestock so it can be used to build an insurance index that truly reflects the risks the pastoralists face.”

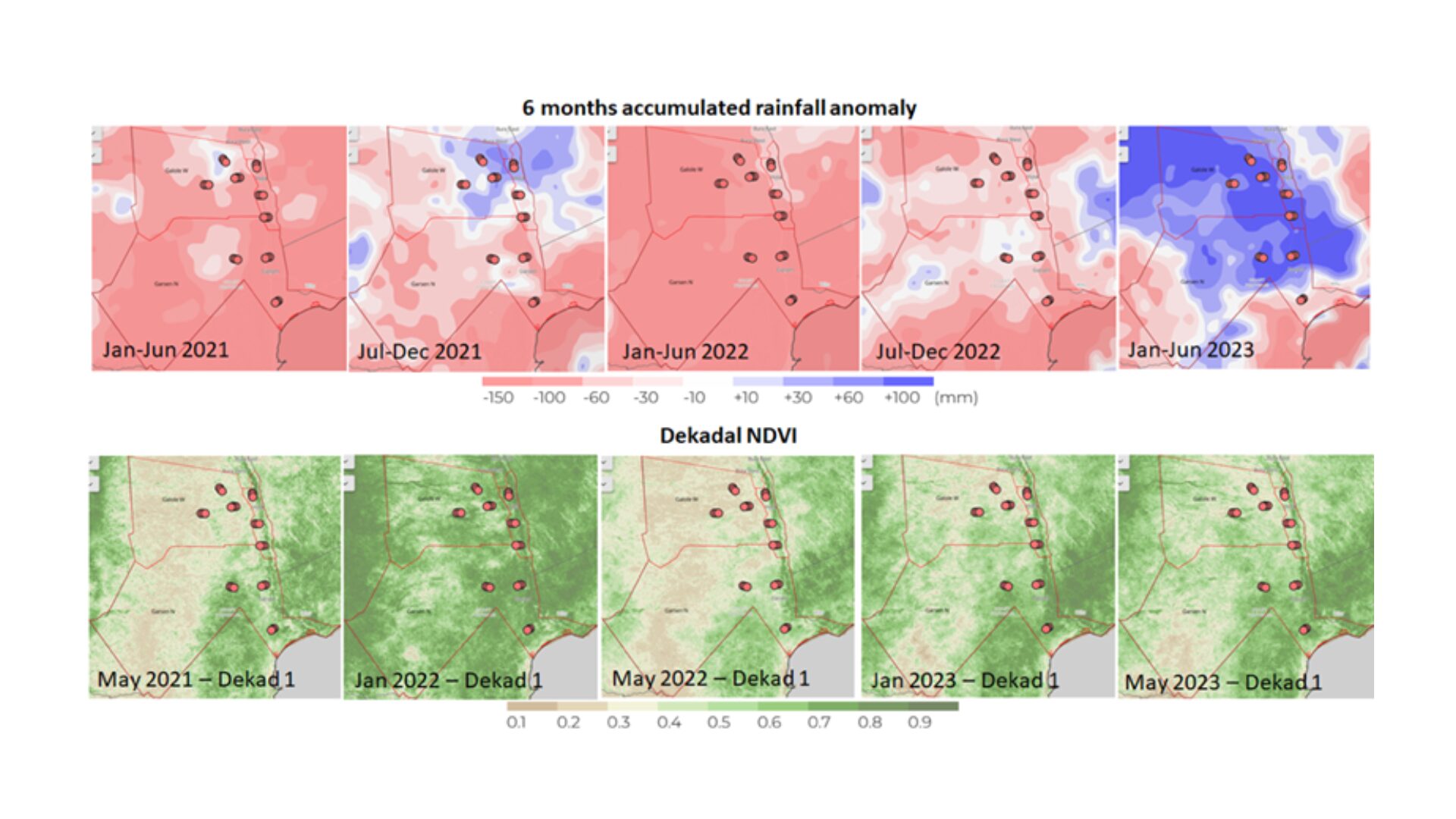

NDVI, derived from satellite imagery, measures how green the vegetation is compared to normal levels. When vegetation levels drop drastically, often due to drought, it signals that herders may soon struggle to feed their animals. That’s where index-based livestock insurance comes in: it uses NDVI data to trigger payouts when vegetation falls below a certain threshold.

But how does scientific data become an insurance tool? Professor Ogutu breaks it down:

“I use the NDVI data to build an index that reflects how much vegetation has changed compared to normal,” she says. “Then, using historical NDVI trends and loss data, I estimate how often payouts might happen. This helps set insurance premiums that are affordable but sustainable.”

The process involves collaboration between actuaries and GIS specialists. While GIS teams ensure the satellite data is accurate and reliable, actuaries like Professor Ogutu validate and model it to ensure it fairly represents on-the-ground realities.

“We use what we get from the GIS team to make actuarial models that make the insurance index fair and reliable,” she adds.

This collaboration between science and finance ensures that pastoralist communities can receive timely support when drought strikes, without lengthy verification processes. By turning vegetation data into a financial safety net, NDVI-based insurance is helping make climate resilience more data-driven and equitable.