The Adaptation Finance Gap, the New Collective Quantified Goal on Climate Finance, and the Private Sector

/

Authored by Paul Watkiss and Blanche Butera

Since its launch in 2023, ECONOGENESIS has significantly advanced the global conversation on climate finance. Over the past year, the team has directly contributed to a flagship international climate publication – the United Nations Environment Programme Adaptation Gap Report (AGR) of 2025. In the 2025 edition, released ahead of the 30th COP in Belém in Brazil, the project contributed to a vital update on the size and nature of the gap between the needs of developing countries and international finance flows, as well as providing new analysis of the potential role of the private sector.

The challenge

Supported under the CLimate Adaptation and REsilience (CLARE) framework research programme, ECONOGENESIS has been working to assess the global costs of adaptation for developing countries. The previous work of the team – as reported in the AGR 2023 and the supporting Adaptation Finance Gap Update 2023 – was referenced in the COP29 Negotiation decision text of the new collective quantified goal on climate finance (NCQG). This set a goal, with developed countries taking the lead, to provide at least US$ 300 billion per year by 2035 to developing countries for climate action (mitigation and adaptation).

In view of the timeline for the NCQG, as well as countries’ new NDC targets that are expected ahead of COP30, it was necessary for the team to reassess the global costs of adaptation and align it with the year 2035. These results are highly relevant for the continued work stream of the NCQG, and the Baku to Belém roadmap to 1.3T which will be discussed at COP30.

Results

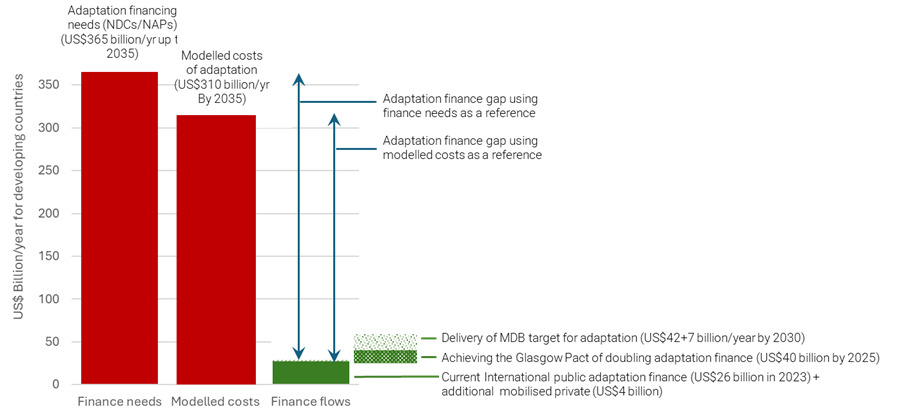

The ECONOGENESIS contributions to the Finance Chapter of the 2025 Adaptation Gap Report sets out new estimates of global adaptation finance needs for developing countries for the year 2035. The team estimates these adaptation needs to be between 310 and 365 billion US$ per year for 2035. This is over ten times more than the current annual flows of international public finance provided from developed to developing countries, assessed at only 26 billion US$ (for the year 2023, the latest year available).

The results indicate a strong need to urgently scale up adaptation finance. They indicate that the Glasgow Climate Pact, to double international public adaptation finance by 2025, is likely to be missed unless there is a significant scale up of public finance. It also demonstrate that the NCQG goal of US$300 billion/year – which has to finance both mitigation and adaptation – will be insufficient to meet adaptation finance needs.

The role of the private sector in adaptation?

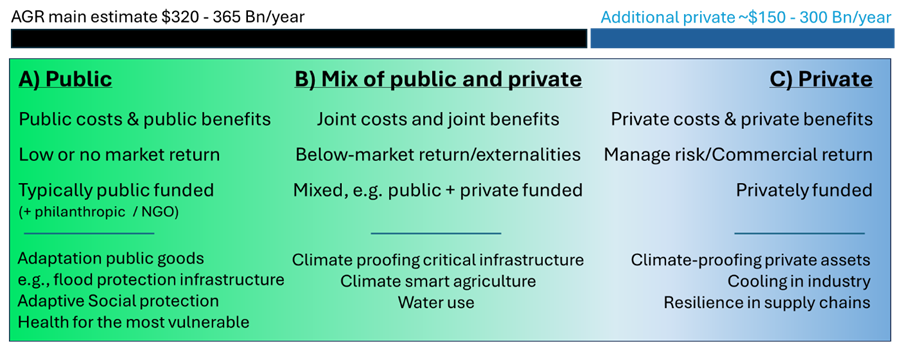

Given the size of the adaptation finance gap, recent attention has turned to the potential for the private sector to help fill the finance gap. The ECONOGENESIS team has looked at this issue, developing a typology of adaptation actions and the potential roles of the public and the private sector, shown in Figure below. This identifies the types of national adaptation activities prioritized in NAPs and NDCs –shown on the left and centre – and differentiates these from pure private activities on the right – the costs of which are not included in finance needs submitted by countries in NAPs and NDCs. The analysis also differentiates between the financing of adaptation, and the actual funding of adaptation, as the latter provides critical information on who ultimately pays for adaptation.

While the numbers are indicative, AGR assesses that the private sector could realistically deliver 15%-20% of nationally identified adaptation priorities in developing countries, which is approximately US$ 50 billion per year. The relatively low level is explained by the high proportion of public goods and public funded activities. This shows that while there is some potential for the private sector to help bridge the adaptation gap, it can only make a modest contribution. Finally, the analysis identifies that insufficient attention has been given to the distinction between financing and funding, and issues of equity. The team identify that this issue needs to be brought out more transparently in negotiation discussions.